1. What is an Insurance Loan?

An insurance loan allows you to borrow money from your life insurance policy’s cash value. This only applies to permanent life insurance policies like whole life or universal life—not term policies.

You’re essentially borrowing from yourself, using the insurer as the middleman. No credit check is required, and you can access funds relatively quickly.

2. Key Features of Insurance Loans

A. Eligibility

Only policies with cash value (like whole life or universal life) are eligible. Term life policies do not qualify.

B. Loan Amount

You can usually borrow up to 80–90% of your available cash value.

C. Interest Rate

The insurer charges interest (typically 5–8%), which accrues over time.

D. Repayment

You can repay on your own schedule, but if unpaid, the balance plus interest will reduce your death benefit.

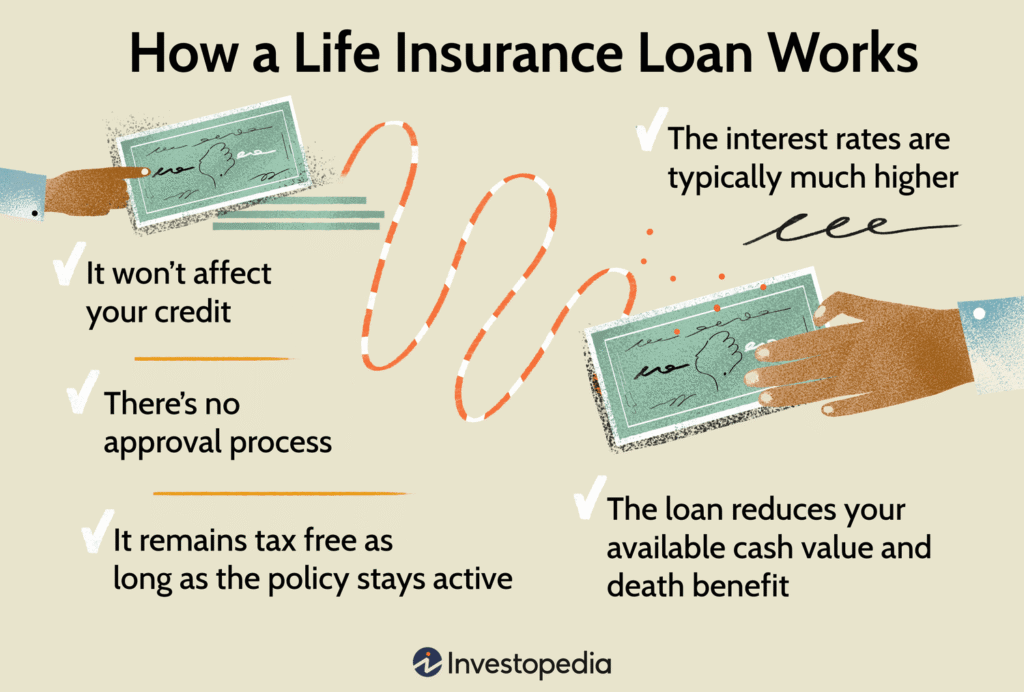

3. Advantages of Insurance Loans

✅ No Credit Check

Since you’re borrowing your own money, there’s no credit approval needed.

✅ Fast Access to Funds

Funds are disbursed quickly—often within days.

✅ Flexible Repayment

There’s no mandatory repayment schedule, giving you flexibility.

✅ Tax-Free Access

Loans are typically not taxed unless the policy lapses.

✅ Death Benefit Protection

As long as you repay, your full death benefit stays intact.

4. Disadvantages and Risks

❌ Reduced Death Benefit

Any unpaid loan balance is deducted from your policy’s payout.

❌ Interest Accumulates

Interest keeps compounding—even if you’re not making payments.

❌ Policy Lapse Risk

If the loan grows too large, your policy could lapse, and you could lose your coverage.

❌ Tax Liability

If the policy lapses with a loan, the IRS or local tax authority may consider it taxable income.

5. Example: How an Insurance Loan Works

Imagine your policy has a cash value of $25,000. You borrow $15,000 at a 6% interest rate.

- If you make annual payments, you maintain the policy’s value and protect the death benefit.

- If you never repay, the balance grows. Upon your death, that amount is deducted from what your beneficiaries receive.

6. When Should You Use an Insurance Loan?

✔️ Emergency medical expenses

✔️ Short-term financial hardship

✔️ Education funding

✔️ Home repairs

✔️ Business capital

Be sure to plan ahead for repayment so you don’t endanger your policy.

7. Best Practices for Managing Insurance Loans

✔️ Track Your Loan Balance

Keep an eye on interest and how much is owed.

✔️ Pay At Least the Interest

This prevents your debt from compounding uncontrollably.

✔️ Leave a Buffer

Don’t borrow the full cash value—leave room for the policy to remain active.

✔️ Review Policy Terms

Understand loan terms, interest rates, and consequences.